[ad_1]

David Solomon, Chairman & CEO Goldman Sachs, speaking on CNBC’s Squawk Box at the World Economic Forum Annual Meeting in Davos, Switzerland on Jan. 17th, 2024.

Adam Galici | CNBC

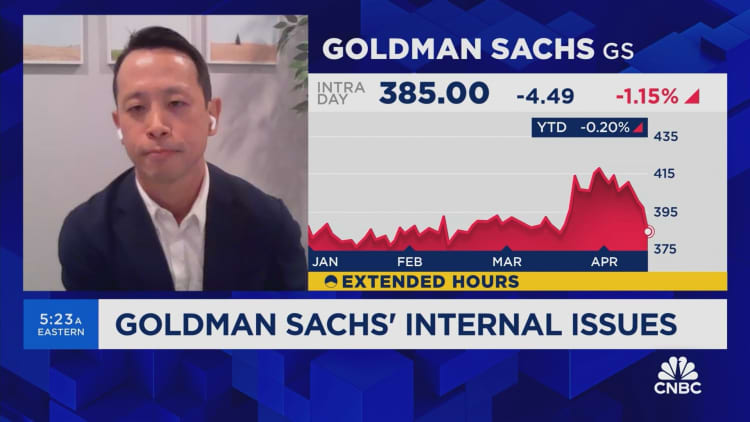

Goldman Sachs on Monday posted first-quarter profit and revenue that topped analysts’ expectations, fueled by a surge in trading and investment banking revenue.

Here’s what the company reported:

- Earnings: $11.58 per share, vs. expected $8.56 estimate of analysts surveyed by LSEG

- Revenue: $14.21 billion, vs. expected $12.92 billion

The bank said profit jumped 28% to $4.13 billion, or 11.58 per share, from the year earlier period, thanks to a rebound in capital markets activities.

Goldman Sachs CEO David Solomon has taken his lumps in the past year, but hope is building for a turnaround.

Dormant capital markets and missteps tied to Solomon’s ill-fated push into retail banking should give way to stronger results this year.

Rivals JPMorgan Chase and Citigroup posted better-than-expected trading results and a rebound in investment banking fees in the first quarter; investors will be disappointed if Goldman doesn’t show similar gains.

Unlike more diversified rivals, Goldman gets most of its revenue from Wall Street activities. That can lead to outsized returns during boom times and underperformance when markets don’t cooperate.

After pivoting away from retail banking, Goldman’s new emphasis for growth has centered on its asset and wealth management division. The business could see gains from buoyant markets at the start of the year, though it also has taken write-downs tied to commercial real estate in the past.

Solomon may also field questions about the latest examples of an exodus in senior managers, including his global treasurer Philip Berlinski and Beth Hammack, co-head of the bank’s global financing group.

On Friday, JPMorgan, Citigroup and Wells Fargo each posted quarterly results that topped estimates.

This story is developing. Please check back for updates.

[ad_2]

Source link